With ability to perform highest transactions per second, PayU is the only platform in India to withstand high volume sales.

Consistent Uptime of 99.98% for 2 years

With our strategic advantages, we ensure to provide

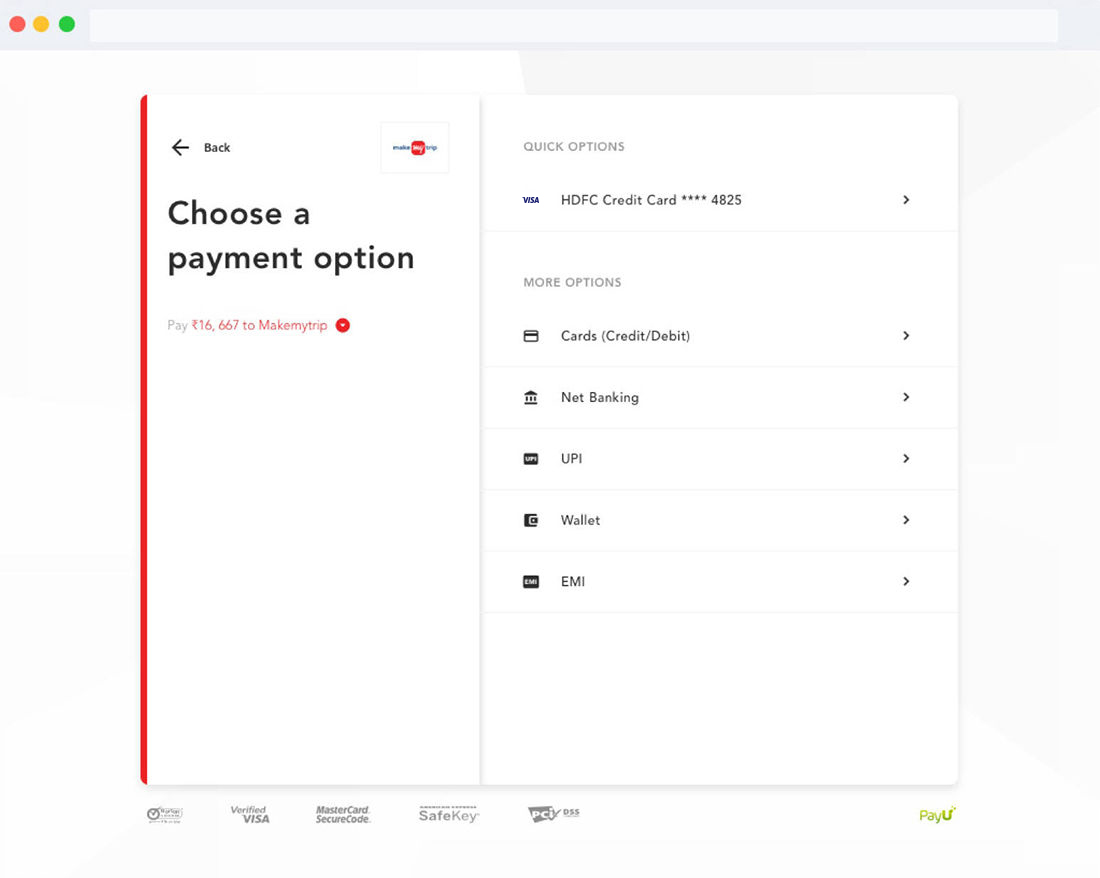

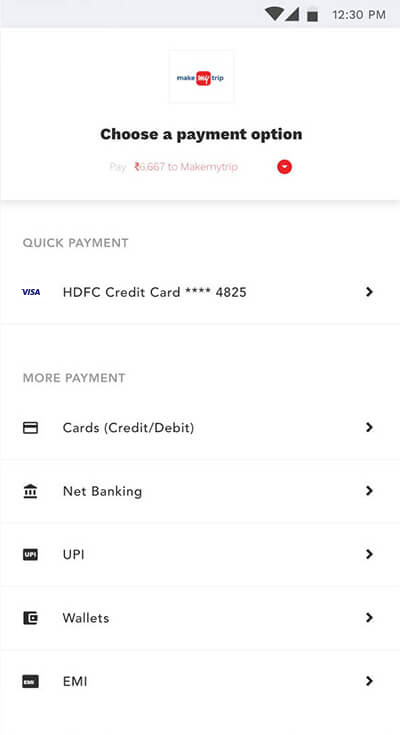

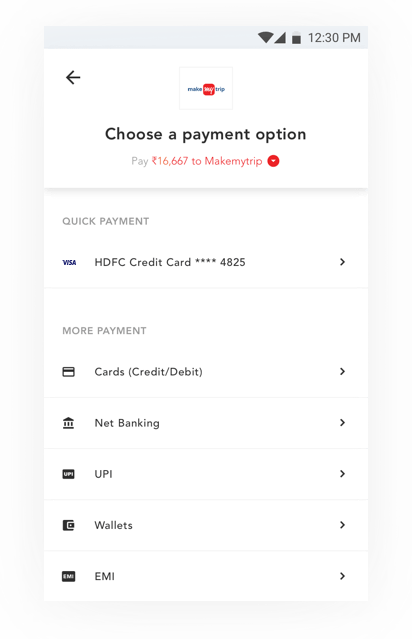

Your customers can pay you with any payment options, no matter where they are.

(Visa, Mastercard, Amex, Rupay, Diner)

Choose a payment option

Choose a payment option

Choose a payment option

Choose a payment option

Choose a payment option

Choose a payment option

(Visa, Mastercard, Amex, Rupay, Diner)

75+ Banks

100+ Banks and third party apps

15 Wallets

Cards & Cardless

Lazypay, Ola postpaid

Our checkout UI works seamlessly on any interface

Choose from multiple ways to show the checkout UI to your customers.

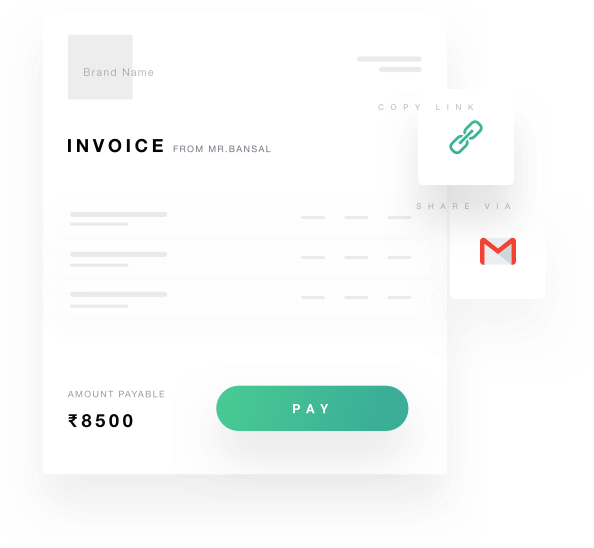

Send GST compliant professional invoices to your customers and allow them to make the payment from the invoice itself.

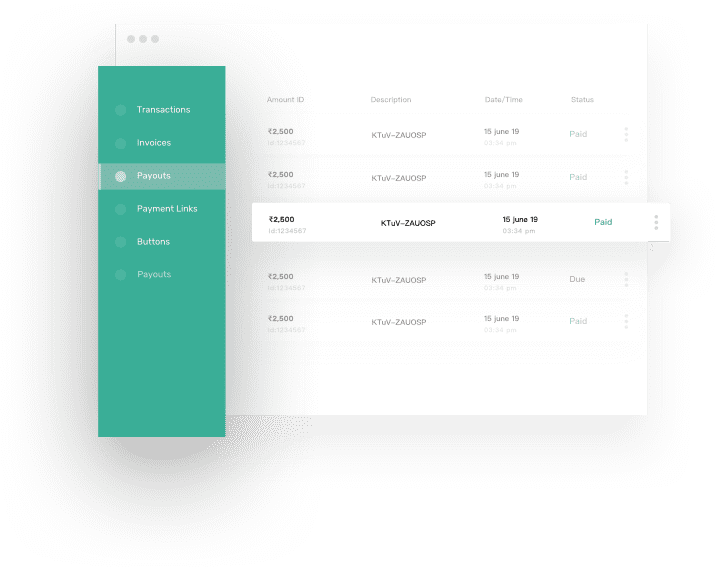

PayU automates bulk transfers to vendors via APIs and offer a much simpler alternative to uploading files on the bank portal.

With just one integration allow your customers to pay their utility bills from within your platform.

Responsive payment solution for your iOS and Android Apps

Integrate our Payment Gateway for Mobile App and collect payments from within your Android or iOS App.

The SDK comes with custom UI where you can control the look and feel of the entire experience.

Accept payments in 100+ foreign currencies

Choose payment modes you need or set up recurring payments.

Apart from the default payment modes like Credit Card, Debit Card, and Net banking, we give you the flexibility to choose the additional payment options like UPI, Wallets or EMI, etc., you want to show your customers

With PayU Subscriptions collect a fixed amount from your customers at a regular interval.

We allow our merchants to collect transaction worth less than INR 2000 without OTP verification, which gives a smooth checkout experience to the customer and also increases your conversion rate.

Boost your success rate with these great tools.

True to its name, this feature will make sure that your transactions reaches the bank irrespective of poor network or bank server issue.

With One Tap Payment, all you need is one click to complete a payment securely. Which means a stored card user does not have to remember CVV, read OTP, switch tabs and enter OTP to do a mobile payment. All it takes is just One Tap on the stored card and it is done!

0-Redirect allows transaction to be completed on the merchant’s page itself. With no OTP redirection, the chances for a successful transaction increases.

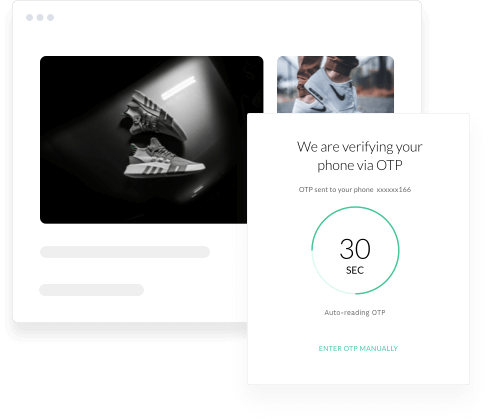

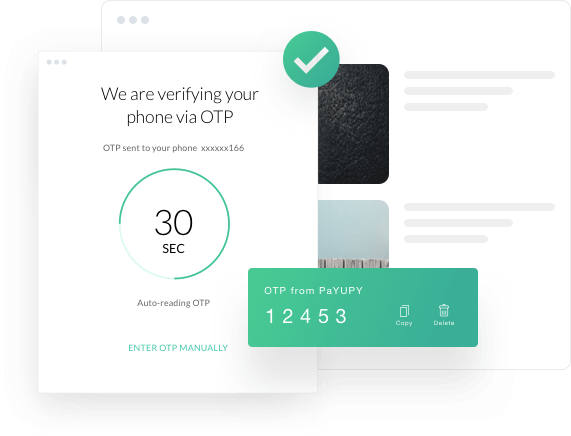

Provide a user friendly interface to your mobile users when they are on a bank’s page, filling OTP and other account details.

For Android users, this feature can auto-read the OTP from user’s device to give a seamless and faster checkout experience

Our engine automatically detects the health of different acquiring gateways and routes the transaction to the best gateway. This helps provide upto 12% increased conversion rates.

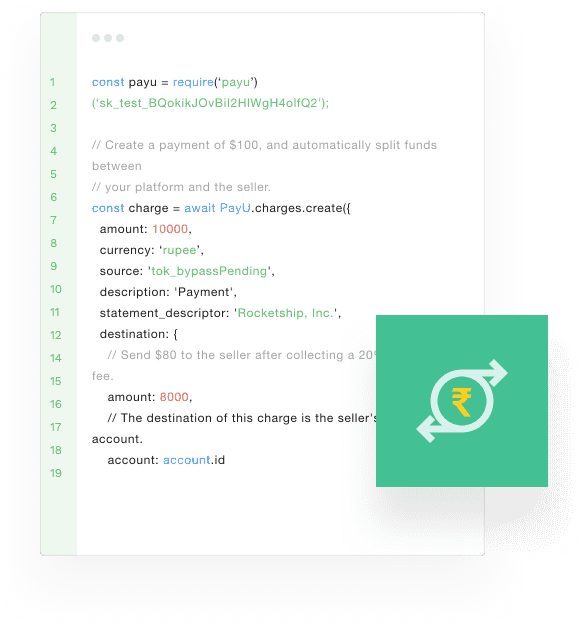

Want to split the payment amount and settle it with a third party? Worry no more! This feature will split the payment however you like and settle the split amounts between your account and other receiver’s account.

Get Automated payments from your customers by getting E-NACH & E-MANDATE. The amount will be automatically debited from customer’s account on every fixed day of the month.

Create custom fraud rules and assess your fraud management performance from a unified dashboard.

PayU’s payments engine is built for global internet businesses facing evolving fraud threats. We constantly tweak our algorithms, test which attributes are most relevant, and generate compound signals to help precisely identify and block fraud.

We provide Chargeback facility when the consumer escalates a dispute about a purchase to his bank. This feature includes settling bank processing errors, duplicate billing, identity theft, disputes over price charged and processed or missed refunds

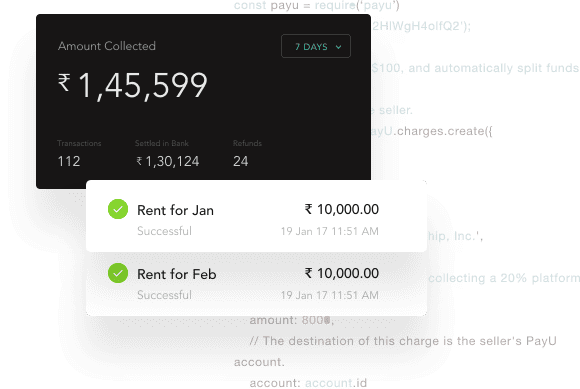

Settlement is the process by which the money paid by your customers is transferred into your bank account after deducting the transaction charges. We ensure that your amount is settled in your account within the stipulated time.

In addition to the ensured settlements promise by PayU,the merchant has an option of choosing the time when he wants his accounts to be settled.

Reconcilation feature includes automated claim mails and transaction level reconcilations. PayU and the bank are in sync with each other regarding each of the transaction carried out from the merchant’s end.

PayU enables merchants to provide instant refunds to their customers in their bank accounts. Instant refunds has three features available: Online Refund APIs, Refunds & Query APIs and Refund to any destination account.

Easily access all your transaction information in a unified dashboard. Drive meaningful inferences and insights for faster business growth.

Get insights on conversion rates through dedicated reports. Play around with funnels to pivot your success rates on different parameters such as Issuer, PG, Card type and many others. Monitor and analyze your transactions on real time basis and apply smart filters for enhanced traceability.

Keep your account safe and secure with PayU.

PayU has PCI- DSS certificates, 3D security systems and Anti fraud systems. We follow EV SSL protocol. We have dedicated anti fraud team and independent data centers which minimizes the risk of failure and guarantees continuity of transactions and security for all the user data.